Q&A: Can I leave my 401(k) to my minor children when I die?

Mar 01, 2023

QUESTION

Q: Can I leave my 401(k) to my minor children when I die?

–Pondering Parent

ANSWER

A: Dear Pondering:

Though you can technically name a minor child as a beneficiary of your 401(k), IRA, or other employment-sponsored retirement accounts, it’s never a good idea. Minor children cannot inherit the account until they reach the age of majority—which can be as old as 21 in some states.

If a minor is listed as the beneficiary, upon your death, your retirement account would be distributed to a court-appointed custodian, who will manage the funds (often for a fee) until the age of majority. If you want your child to inherit your retirement account, you should set up a trust to receive those assets instead.

You can then name a trustee to manage the account until your child comes of age. By doing so, you get to choose not only who would manage your child’s money, but within the trust’s terms, you can stipulate how and when the account’s funds should be distributed and used, which can help them from being lost or squandered.

As your Personal Family Lawyer®, we can help you create a trust to hold your 401(k) for your minor children to ensure your heirs get the maximum benefit from your retirement savings.

*ADDITIONAL SUPPORT PACKAGES*

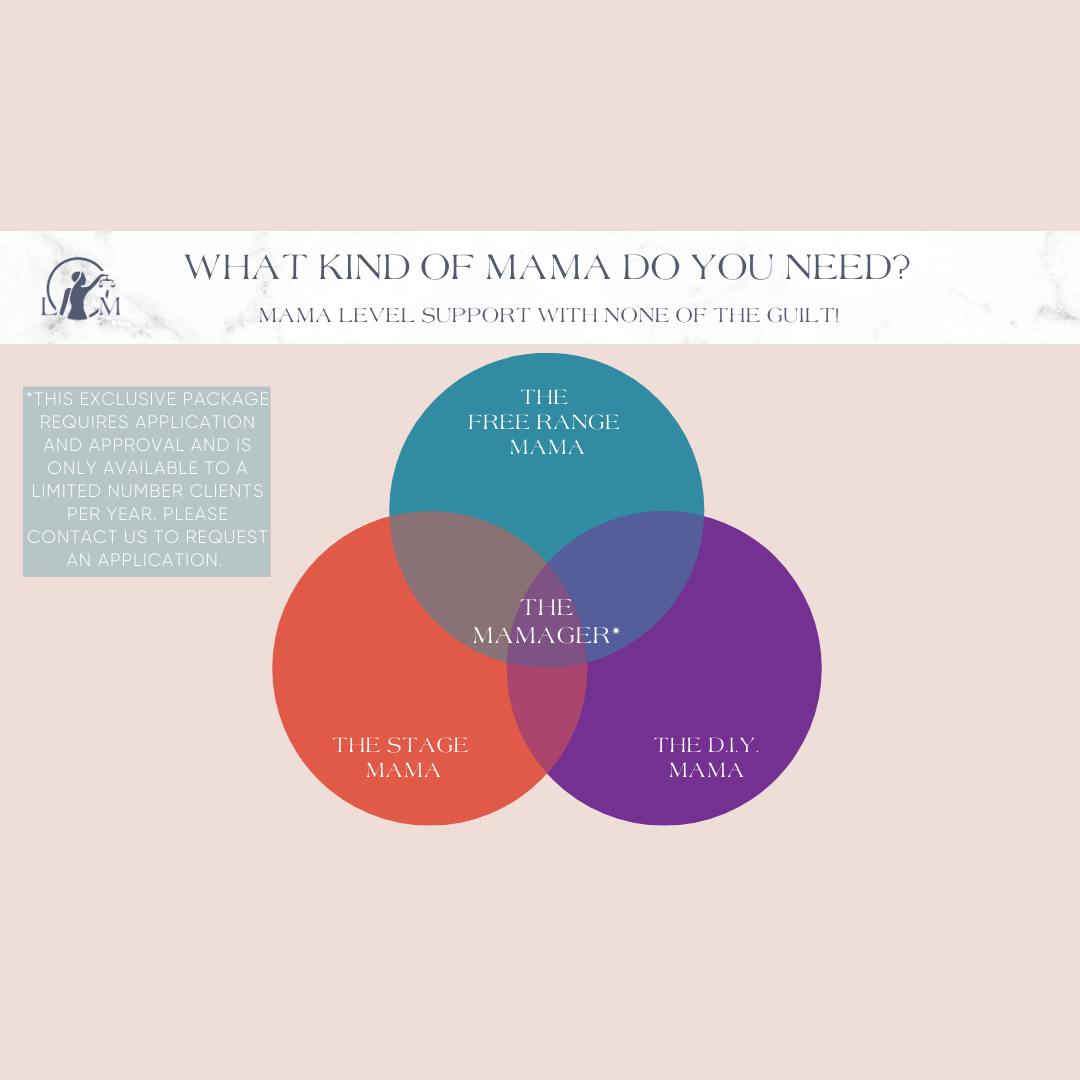

Have you been putting off planning because you simply don't have the time? Ask us about our LEGAL MAMA EASY BUTTON! You'll get our BEST plan with the MOST financial protections and any level of additional support with homework, funding, paperwork filling out, etc. What kind of Mama do YOU need?

*INTEREST FREE FINANCING THROUGH AFFIRM*

*THE FAMILY WEALTH PLANNING SESSION*

Click the photo to learn about my unique planning process, which starts with a Family Wealth Planning Session:

Many of the issues in today's article are addressed throughout membership with yearly family meetings. Once you finish your planning, we can help you keep your plan up-to-date and keep your family up to date as well. Membership also offers loads of perks like unlimited communication on your legal needs and more. Just one more way Legal Mama goes above and beyond as your Personal Family Lawyer for Life!

Feeling overwhelmed by the Estate Planning Process? Want an Estate Planning Life Hack? Sign up for "Sarah's Plan"! Our MOST comprehensive plan at our most reasonable price in a FRACTION of the time. All you have to do is fill out a handful of questions online, pay our discounted fee, and know that your planning is completely DONE! Want to discuss this option in 15 minutes or less? Schedule a free consultation call and we'll have your planning done in no time! Otherwise, follow this link to sign up for Sarah's Plan on the spot!

Next ONLINE Webinar:

This article is a service of Sarah Breiner, Personal Family Lawyer®. We don’t just draft documents; we ensure you make informed and empowered decisions about life and death, for yourself and the people you love. That's why we offer a Family Wealth Planning Session,™ during which you will get more financially organized than you’ve ever been before, and make all the best choices for the people you love. What is a Personal Family Lawyer®? A lawyer who develops trusting relationships with families for life.

You can begin by contacting Sarah today to schedule a Family Wealth Planning Session.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.